According to information from the Vietnam Steel Association, in March, finished steel exports stood at 956,000 tons, up 75.4% over the previous month. Export value reached $908.6 million, up 71.9% compared to February and up 1.1% over the same period last year.

In the first quarter, Vietnam exported about 2.3 million tons of steel, down 22.2% over the same period last year but the value was 2.3 billion USD, up 12.5% over the same period last year. last. The main markets in the first quarter were ASEAN (40.6%), EU (19.3%), US (8.3%).

|

|

Steel exports in March were at more than 956,000 tons. Photo: Industry and Trade Newspaper |

Four positive points of the steel industry in 2022

In the Steel and Galvanized Steel Industry Outlook report of Mirae Asset Securities Vietnam (MASVN), experts have a positive assessment for the steel industry this year.

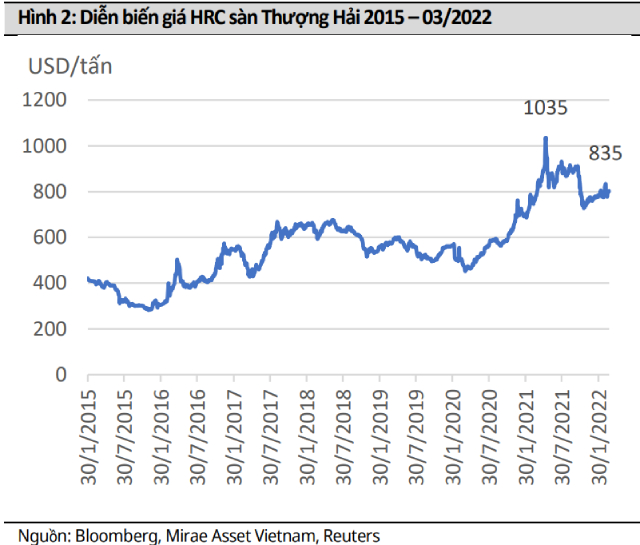

Firstly, the price of hot rolled coil (HRC) is expected to remain high as China and Australia continue to trade tensions, putting pressure on iron ore supply.

Due to the influence of iron ore and coke prices, the price of HRC traded on the Shanghai floor in the period of June 2021 up to USD 1,035/ton, up 130% compared to the bottom of USD 463/ton in 2020. However, In the fourth quarter of 2021, speculative demand for HRC declined when the Chinese government asked steel mills to reduce output to make room for coal for peak electricity demand in winter as well as to limit environmental pollution and price. HRC has adjusted and balanced around $760/ton. With pressure from coal and iron ore prices, MASVN forecasts that the Shanghai HRC price will return to $850/ton in the second quarter of 2022.

|

|

HRC price movement on Shanghai, China. |

Looking back at 2021, the reopening of the North American or European markets, causing the economy from the third quarter of 2021 to boost the demand for steel of many types of steel, including HRC. The price of HRC in the North American market increased by 100% and peaked at $1,920/ton in August 2021.

Thanks to the rapid price increase of HRC in 2021, steel companies all increase their gross profit margin by 3-6% in 2021 thanks to the difference in input material prices.

Second, the industry's output is forecasted to reach 33.3 million tons in 2022, up 8%. In 2021, the industry's steel output reached 30.8 million tons, up 32.5% over the previous year. In which, export output reached 7.5 million tons, up 66% compared to 2020, corresponding to a total export value of 12 billion USD, the highest in history. In the galvanized sheet segment, the whole industry's output in 2021 will reach 6 million tons, up 52.5% compared to 2020, of which exports account for 45%, equivalent to 3.4 million tons, up 133% over the previous year.

According to MASVN, the demand for steel industry is directly related to the real estate industry. However, due to the development of the Covid-19 epidemic, the real estate industry is not really active in 2021. The industry's brightest point to help keep output from falling comes from the government's stimulus for public investment as well as public investment. Huge demand comes from Europe and America.

In 2022, MASVN believes that the real estate and construction industries will recover, thereby boosting the output of the entire steel industry. However, output will hardly have a sudden growth like in 2021 when most domestic steel companies have run at full capacity and no new big projects have been introduced. Therefore, MASVN predicts that steel output this year will reach 33.3 million tons, up 8% compared to 2021, export volume alone will reach 8.7 million tons - up 15% compared to last year.

Third, opportunities will open up in the export segment this year. MASVN believes that the export market will continue to expand this year under the impact of the Russia-Ukraine war. Currently, Russia ranks second in steel exports to the EU, with the proportion of 14.1% flat steel and 19% long steel. Ukraine accounts for 8% of flat steel and 7.4% of long steel, while Belarus accounts for 14.4% of long steel. The serious shortage of supply will help Vietnamese steel companies continue to benefit from exports, especially from the European and American markets.

Besides, for the whole year of 2021, anti-dumping tax policies against Vietnam have not changed significantly, remained at very low level or not applied. Except for some products exported to Thailand or Australia, which account for less than 5% of total steel exports, the export segment of the steel industry promises to continue a bright 2022 ahead.

Some risks that the steel industry may face

However, MASVN also pointed out some risks that the steel industry may face this year.

The first is the risk of material price fluctuations. The steel and galvanized steel industry has a big risk because raw material costs account for 65-75% of production costs. Especially in the galvanized steel industry, the price of HRC accounts for more than 80% of the cost of input materials, making the profit of the whole industry fluctuate greatly according to HRC.

Second, the price of coke has increased very strongly along with the price of iron ore continuously trending up. In the context of high selling prices, it may cause the construction market to decrease its growth rate, thereby directly affecting output.

Third, the risk of anti-dumping tax on the export market. The steel industry currently exports (accounting for 19.6% of total sales volume) to countries such as China, EU, US.... Therefore, there is still a risk that the tariff policy will change in the context of the ongoing trade war between China and other countries.

In addition, there is the risk of export restrictions. Currently, in March 2022, the price of construction steel has increased to VND 18.3 million/ton. MASVN believes that if the price of construction materials is high, some steel lines will be restricted for export. In which, construction steel billet is the product line that will face this risk first.

NDH

English

English  Vietnamese

Vietnamese

.jpg)

w300.jpg)