The market outlook for 2022 remains positive as the global economy continues to recover from the Covid-19 pandemic.

The pandemic has caused most commodities to plummet in 2020 and steel is no exception. During the first year of the Covid-19 pandemic, a sharp drop in demand from downstream industries had a negative impact on the steel industry throughout most of the first half of 2020. In particular, the pandemic dealt a heavy blow to the industry. US steel industry, which is affected by the impact of the US-China tariff war.

However, steel demand recovered quickly after that as the activity of steel consuming sectors such as auto, construction and machinery was restored after the global restrictions were eased. liquid.

The recovery of important steel-using industries such as construction and automobile shows that the steel market has received favorable winds. The auto industry has bounced back from the pandemic, and orders in the construction and non-residential sectors have also been strong. Demand to build homes for purposes other than residential has returned to near pre-pandemic levels. The energy market is also gradually cooling down.

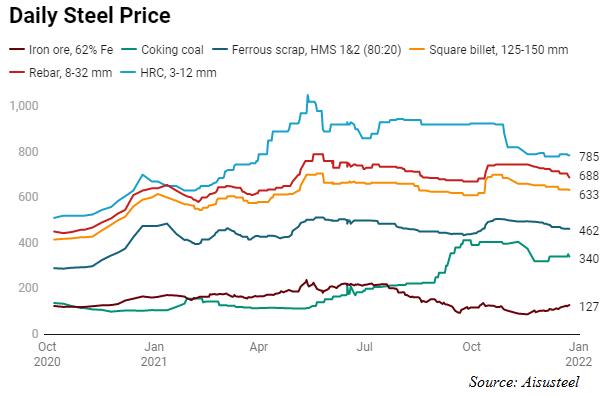

Steel prices increased unprecedentedly in 2021 in key markets amid tight supply and low inventories of the entire supply chain. U.S. steel prices hit historic highs as prolonged supply shortages boosted profits for steelmakers, despite rising raw material costs, including scrap, and other difficulties. in the supply chain.

Remember earlier, when the Covid-19 pandemic just started to break out, the price of hot rolled coil (HRC) dropped to only about $440/ton in August 2020. However, the price has since recovered significantly, surpassing the level of 1,900 USD/ton in August 2021 as supply and demand are still far apart.

Unfortunately, after reaching a 'peak' in September 2021, HRC steel prices have once again been under downward pressure since October due to a drop in demand for cars after auto manufacturers had to adjust output. However, the price of HRC steel is still fluctuating around USD 1,700/ton and showing signs of entering a new bull run, which is still much higher than the previous year. , and 4 times higher than in August 2020.

World steel stocks in 2021 will win big, it is forecasted that 2022 will continue - Photo 1.

Iron and steel price movements

Stocks of many steel companies also rose sharply in line with the price trend, most notably: Commercial Metals Company, TimkenSteel, EVRAZ plc and United States Steel Corporation X…

Profits of TimkenSteel have increased by 425.8% in the fourth quarter of 2021, of EVRAZ by 244.8% this year, of EVRAZ by about 36% in the fourth quarter of 2021…

Although steel demand in the auto sector is slowing due to the chip crisis, strong demand from other downstream markets, including construction, and supply disruptions have seen many mills shut down to slow down production. scheduled maintenance, which has kept HRC steel prices high recently, is forecast to continue this trend in 2022, boosting profit margins of steel businesses.

Although the new wave of Covid-19 is clouding the future of commodity markets, which may slow down the recovery of the steel industry, MEPS is still optimistic, forecasting a rise in global flat steel product prices. in the first months of 2022. Meanwhile, steel prices on the North American market are expected to continue falling in the coming months due to weakening purchasing activity amid the stockpiling of distributors and service centers. service increased. The country's steel manufacturers may lower their selling prices to boost sales.

In Asia, the average price of flat steel products is forecast to decrease in the near future. Violent waves of outbreak in the entire region are dampening trading activity as well as market sentiment. It is forecasted that there will be a slight price recovery next spring due to seasonal factors.

From mid-2022, steel prices are forecast to decline in all regions. Consumption growth of flat steel products has slowed down due to the high cost of steel and other materials as expected. Inflationary pressures are likely to reduce consumer spending. Furthermore, the recovery in demand from the auto sector is expected to last, and the economic outlook for 2022 is also relatively strong, despite the risks that come with new variants of Covid-19. and the expected tightening of fiscal and monetary policy in many countries.

Overall, MEPS does not expect steel to turn bearish, despite growing fears among some traders. Accordingly, the global steel trading value will decrease slower than the increase in the past year. Accordingly, the aggregate transaction value of flat steel products tracked by MEPS is forecast to average about $1,220/ton in 2022 - an increase of nearly 60% compared to 2010/2019.

In the context of the steel price forecast to remain above the average level of recent years due to the increase in input costs of the factory and the moves to reduce carbon emissions of the steel industry, steel stocks because of that. is forecast to continue to increase in 2022, although at a slower rate than in 2021.

References: Mepsinternational, Aisusteel

Cafef

English

English  Vietnamese

Vietnamese

w300.jpg)