This creates pressure on world markets, including Vietnam.

China boosts exports of cheap steel

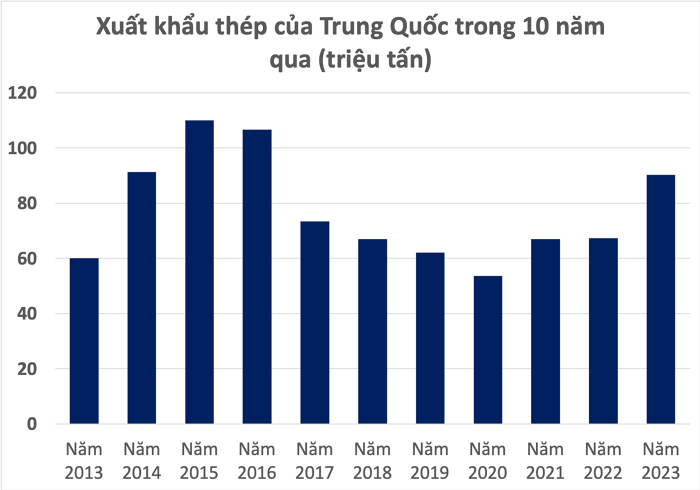

According to data from the General Administration of Customs of China (GACC), the country's steel exports in 2023 will reach more than 90 million tons, an increase of 36% compared to 2023. This is also the highest level since 2016. Price The average steel export in 2023 is only about 706 USD/ton, down 35% compared to 2022.

The majority of steel is exported to regions with few trade barriers, including Southeast Asia, the Middle East, South Asia, Central America...

Source: General Administration of Customs of China (compiled by US)

Vietnam imports 8.3 million tons of steel from China, an increase of 63% compared to 2022 and accounting for the highest proportion of about 78% of the structure of steel export markets to Vietnam. The price of imported steel from China in 2023 averages 681 USD/ton, down 30% compared to last year.

Vietnamese steel businesses are worried about China's wave of export promotion.

Mr. Nguyen Viet Thang, General Director of Hoa Phat Group, said that in 2024 the domestic steel market will face many risks, including that the Chinese economy may not prosper.

“The pressure from the Chinese market is huge. Last year, the country exported more than 90 million tons of steel and is expected to increase to 100 million tons this year. Obviously, many countries are building fences with China. If Vietnam does not have adequate trade protection measures, certainly with its location right next to China, the pressure on this country's steel to pour into the domestic market will be huge. Therefore, we hope that state agencies will have legal and fair support measures," Mr. Thang said.

Previously, Vietnam imposed anti-dumping taxes on galvanized steel products (also known as galvanized steel sheets) imported from China and Korea in 2017 with the highest tax rate of 38.34%. Case code ER01.AD02. After 5 years of applying anti-dumping measures, the Ministry of Industry and Trade decided to end this order.

However, by 2023, steel enterprises submitted documents to petition the Trade Defense Department to initiate a re-investigation of the AD02 case.

Mr. Vu Van Thanh, Deputy General Director of Hoa Sen Group, said that since Vietnam stopped the AD02 case, the amount of galvanized steel imported from China to Vietnam has increased significantly.

“It is extremely difficult for businesses to compete. From the perspective of the galvanized steel industry, we hope the Trade Defense Department will speed up the progress of the AD02 case," Mr. Thanh said.

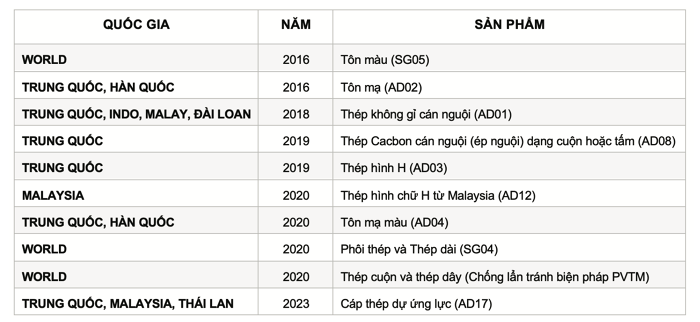

According to statistics from the Vietnam Steel Association, in the period 2016 - 2023, Vietnam has initiated investigations into 10 trade defense cases related to imported steel products. In most cases, steel products originate from China.

Cases in which Vietnam initiated investigations on steel products in the period 2022 - 2023 (Source: Vietnam Steel Association)

Could Chinese steel demand continue to decline, global pressure still great?

Businesses believe that if China's economy recovers in 2024, especially the real estate sector, the country's steel consumption will increase, thereby reducing pressure on the Vietnamese steel market. .

However, according to Reuters, in a recent press conference, officials at the China Metallurgical Industry Planning and Research Institute (MPI) said the world's leading steel manufacturer's demand in 2023 will decrease. 3.3 compared to 2022 and a further decrease of 1.7% in 2024, as construction activity remains subdued.

Accordingly, steel demand last year was at 890 million tons while output reached over 1 billion tons, causing excess supply.

The country's steel industry has come under significant pressure from a debt-ridden real estate sector. Researchers at MPI said construction steel demand in 2023 is estimated to decrease by 4.8% compared to 2022 to 506 million tons.

Steel demand will fall to 875 million tons in 2024, with construction steel demand down 4% next year, they added.

Real estate construction accounts for about 35% of China's steel demand and the sector has struggled this year as major developers have faced liquidity crises and falling sales.

However, Mr. Guan Zhijie, Deputy Engineer-in-Chief at MPI, said China's steel exports next year may decline slightly due to slowing economic growth overseas. However, despite a slight decrease, compared to a fairly large number in 2023, the pressure on the global steel market is still huge.

In a recent report, the analysis department of SSI Securities Joint Stock Company (SSI Research) expects steel prices to recover in the near future, but prices are unlikely to increase sharply because of the real estate market in China. There hasn't been much improvement yet, overall demand is still being affected.

On the other hand, an increase in steel prices relative to input material costs could prompt a return to manufacturing activity in China.

Vietnambiz

English

English  Vietnamese

Vietnamese

.jpg)

w300.jpg)