Iron ore futures for May 2022 on the Dalian Commodity Exchange (China) ended the session down 0.4 percent at 693.5 yuan ($108.84) per ton, ending a four-session streak. increase.

Similarly, January iron ore futures on the Singapore Exchange fell 1.3% to $125.60 a tonne.

China is maintaining a 'zero-tolerance' policy for local Covid-19 cases, with the goal of moving to quickly quell any local outbreaks by imposing regulations. Strict restrictions on movement.

In Dongxing, a Chinese border city next to Vietnam, just one positive case of Covid-19 prompted the local government on December 22 to ask everyone to stop all public transport activities. community and stay at home, information from state broadcaster CCTV.

China is expected to stick to this rigorous approach as Beijing prepares to host the Winter Olympic Games, to be held next February.

Earlier this week, iron ore prices rose to multi-week highs, despite the country's imported iron ore inventories hitting a three-and-a-half-year high following a strong rebound on the prospect of China's economic expansion. stimulus next year.

The price of iron ore imported into China's seaports (62% iron content) rose to $129 a tonne on December 21, the highest since October 12, according to data from consulting firm SteelHome.

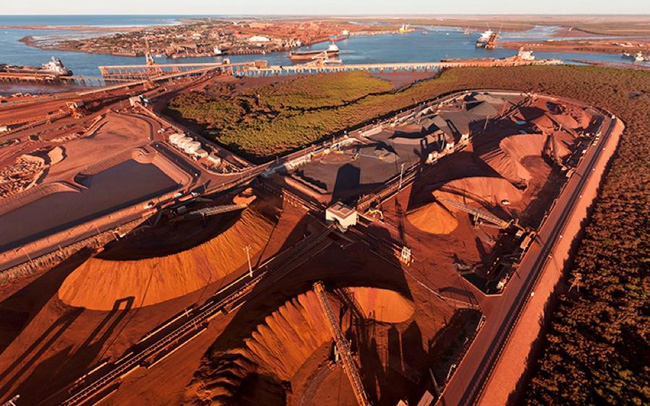

China imported 104.96 million tonnes of iron ore and concentrates in November, up 14.5% from 91.61 million in October, according to the country's customs authority. Imports in November are the highest in 16 months.

The smelters in the east, northeast, southwest and northwest of China have fulfilled their target of controlling crude steel production in 2021, and now continue to maintain some production, leading to import volume. iron ore increases.

As many as 67 iron ore vessels called at major ports in China in the week from December 13 to 19 with an estimated volume of 9.9 million tons, up 0.7 million tons from the previous week.

However, analysts warn that steel demand in China is about to weaken again in the coming cold days as construction activity slows. The time of the upcoming Olympics also forced the country to curb steel production as well as buy iron ore.

"(Steel demand) is gradually shifting from peak season to off-season cycle, and consumption is expected to decline gradually month-on-month," said Huatai Futures analysts.

Rebar, used in construction, on the Shanghai Futures Exchange, fell 0.9% in the session on December 22, while hot rolled coil dropped 1.2%, extending the decline to the second session in a row. following 6 previous gaining sessions. Particularly, stainless steel price this session increased by 0.9%.

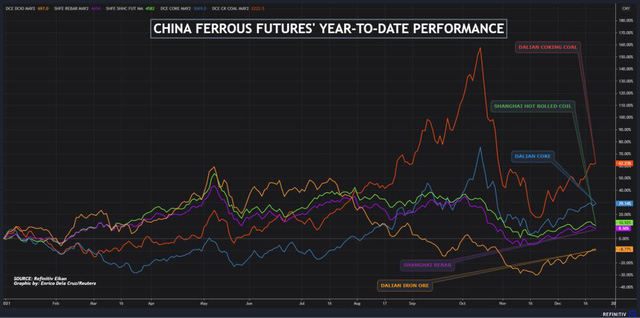

The level of iron and steel price volatility in 2021.

Cafef

English

English  Vietnamese

Vietnamese

w300.jpg)