However, the downward trend in iron ore prices is unlikely to last.

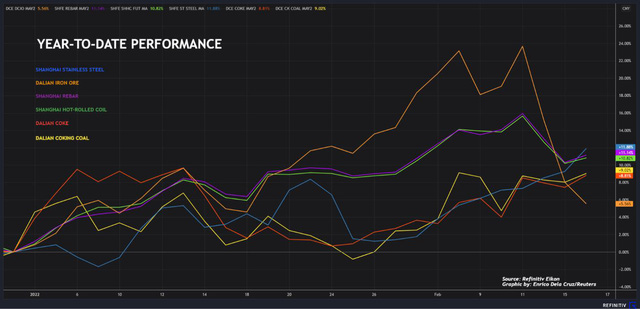

Stainless steel prices in Asia rose to a three-month high on rising production costs and optimism about the demand outlook. On the contrary, iron ore prices continue to come under downward pressure as Beijing continuously tries to prevent any unusual developments in the market.

March stainless steel futures on the Shanghai Stock Exchange ended Feb. 16, up 3.4% to 19,295 yuan ($3,046.21) per ton, after touching 19,355 yuan at one point in the same session. currency, the highest since October 27.

The price of stainless steel this year has increased by nearly 12%, outperforming other metals traded on the Chinese market. The reason is that the price of nickel - the main raw material in stainless steel production - increased sharply due to concerns about tight supply.

The price of iron ore - the main raw material in steel production - although on a downward trend, is still high, making it difficult for China's steel mills to turn a profit.

Prices of other steel products also tended to increase, with rebar on the Shanghai trading floor up 1.9% on February 16, while hot rolled coil increased by 1.5% compared to the previous session.

Analysts at Huatai Futures said that the additional demand to stockpiles of Chinese enterprises after the Spring Festival is expected to continue to support steel prices of all kinds, especially stainless steel.

Steel stockpiles are still higher than at this time last year, but in the winter period stocks need to increase and then gradually decrease when the peak construction season (summer) arrives. This year, steel stocks are expected to decrease earlier than usual due to meeting demand for construction and infrastructure projects.

China's rebar stockpiles as of January 28 stood at 4.92 million tons, compared with 4.86 million tons in the same period in 2021 and 5.18 million tons in the same period in 2020.

In 2021, rebar inventories have increased from a low of 3.37 million tons at the beginning of the year to a peak of 11.6 million tons in mid-March; while in 2020, reserves increased from 2.81 million to 13.0 million also in mid-March.

Contrary to steel, iron ore prices continued to fall for the third consecutive session as China warned that it would strictly handle cases of false information about prices in the market.

The price of iron ore for May contract on the Dalian Commodity Exchange (China) ended February 16, down 1.1% to 720 yuan/ton. Compared to the 5.5-month high reached last week, the price has now lost 16%.

Iron ore with 62% content imported into Chinese seaports has decreased by nearly 11% in the past 3 sessions, down to 136 USD/ton.

Not only warning, Chinese regulators will meet with domestic iron ore traders on February 17 in an attempt to ensure market stability, after the iron ore commodity surged in price recently. this.

China is once again trying to lower iron ore prices. The country's policymaking body has warned market participants that "should not fabricate or publish any false information about prices."

It is not difficult to understand why Beijing wants to cool down the price of raw steel, because the price of iron ore 62% of imports (for spot goods at northern China's seaports) has recently increased back to nearly 150 USD/ton, equivalent to about 150 USD/ton. equivalent to a 68% increase from the 2021 low, of $87, reached in mid-November.

Although after 3 sessions of decline, iron ore prices are now much lower than the record high of $235.55 reached in May last year, but prices are still at the level that Chinese steel mills will have to deal with. struggling to turn a profit, and is expected to push up construction costs, putting pressure on both inflation and economic growth.

While China's move is putting downward pressure on iron ore prices, analysts say the commodity is largely driven by real supply and demand fundamentals.

China's iron ore inventories, assessed by consulting firm SteelHome, were 154.05 million tonnes in the week to January 28, continuing a downward trend from a 2021 peak of 157.5 million , reached mid-December.

Meanwhile, China's steel production is likely to increase in the coming weeks, when the anti-pollution restrictions imposed in the winter will end, which will drag iron ore demand up.

In fact, steel production facilities in this country have been actively purchasing raw materials to prepare for the upcoming production season. Iron ore imports into the country in January 2022 increased sharply, according to Refinitiv data at 94.28 million tons, while according to data of commodities consultant Kpler even higher, at 108.41 million ton. These figures are all much higher than the 86.07 million tons (official data) imported in December 2021. Therefore, the downtrend in iron ore prices may not last.

Cafef

English

English  Vietnamese

Vietnamese

.jpg)

w300.jpg)