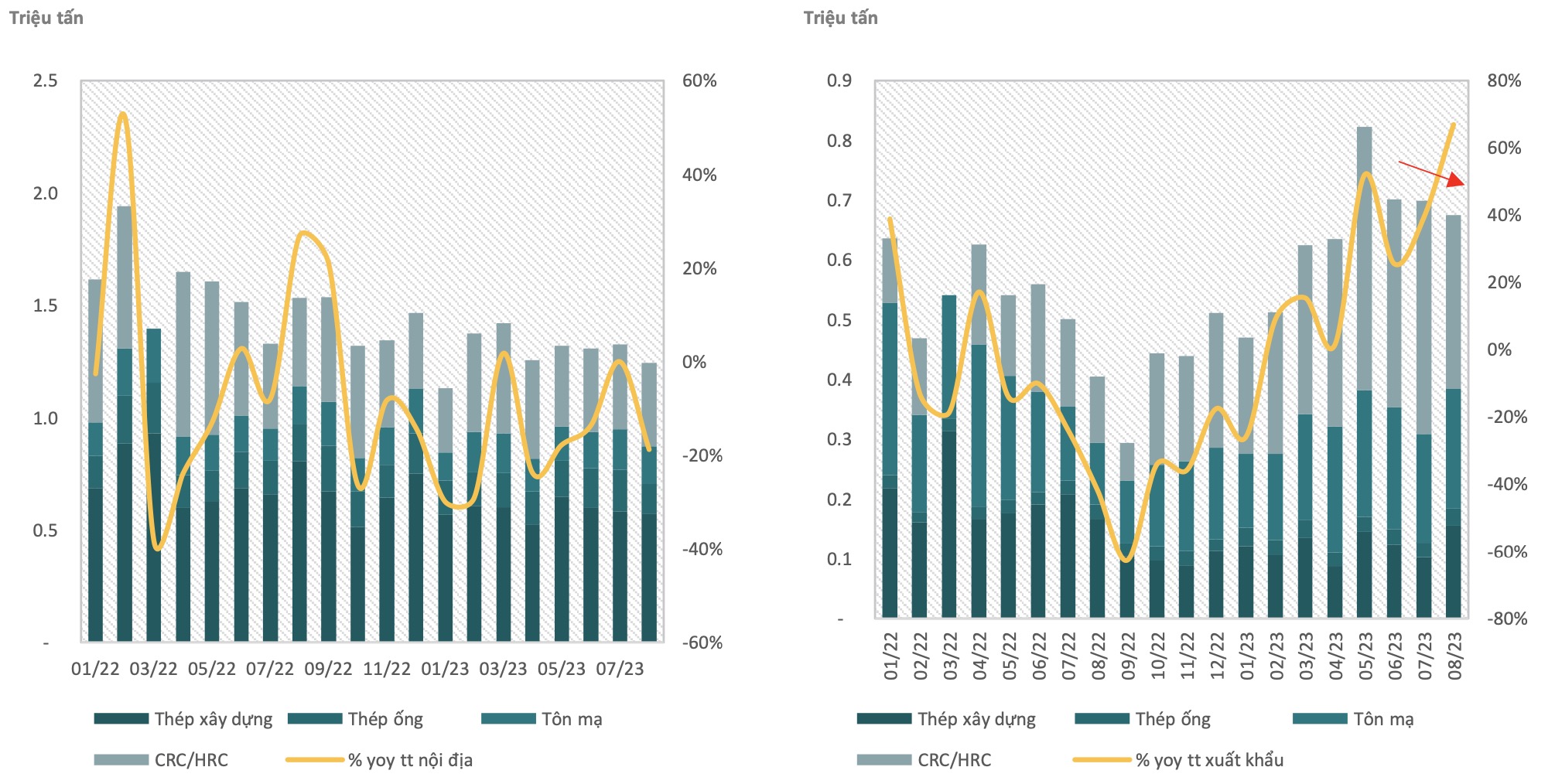

Domestic steel consumption output (left) and steel export output (right) over the months. (Source: Compiled by BSC Equity Research)

In the third quarter of 2023, the total steel consumption of Vietnam's steel industry is estimated to reach 6 million tons, flat compared to the second quarter of 2023. Compared to the third quarter of 2022, steel consumption has increased by 6%, mainly thanks to the effect of the low base level of 2022 and a sharp increase of 73% in steel exports compared to the same period in 2022.

However, entering the fourth quarter of 2023, BSC Equity Research believes that the steel industry outlook is still bleak. Specifically, steel demand in the domestic market will remain weak as the overall market has not recorded signs of recovery in the third quarter of 2023. Weak demand is also reflected in the fact that steel businesses have very limited ability to increase steel prices, even though production costs have increased. At the same time, factories are still forced to push export channels to compensate for domestic channels.

Notably, BSC Equity Research said that Vietnam's steel export output peaked in July - August and will gradually decrease in the fourth quarter of 2023. According to BSC Equity Research, the steel shortage in the key export markets of Vietnam's steel industry, the US and EU, is only seasonal. With consumption demand still weak, the trend of imports from the EU and US gradually decreasing towards the end of the year is inevitable.

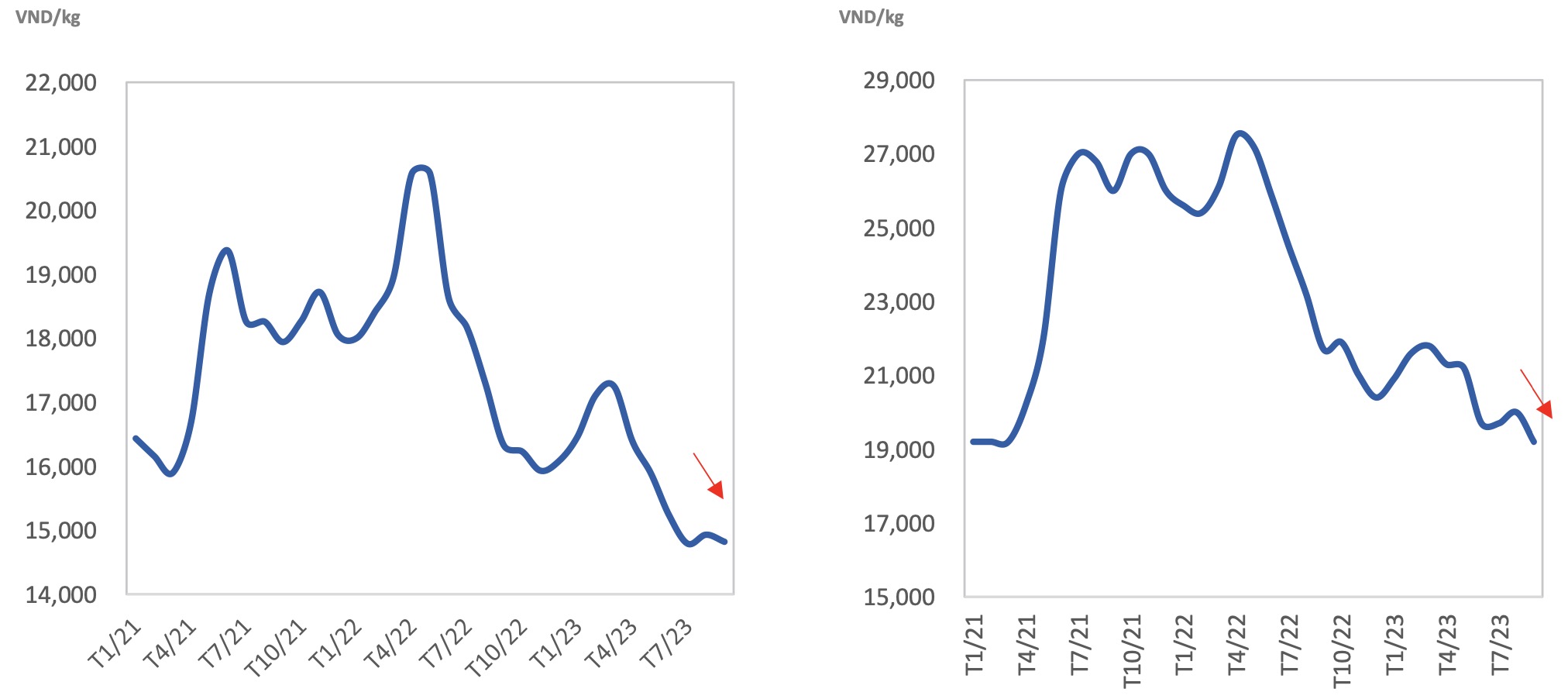

Regarding the outlook for steel prices, BSC Equity Research assesses that domestic steel prices are still on a downward trend since April 2023 due to weak domestic demand and competition from Chinese steel. In the fourth quarter of 2023, world steel prices are expected to move sideways because the market has returned to the supply-demand balance zone.

Domestic steel prices are forecast to be under slight downward pressure due to three main factors: domestic demand remains weak, export channels weaken towards the end of the year, and high competition risks for Chinese steel.

Price developments of construction steel (left) and pipe steel prices (right) on the domestic market in the recent period. (Source: Compiled by BSC Equity Research)

In the third quarter of 2023, the amount of steel imported from China to Vietnam increased sharply by 52% over the same period last year due to competitive Chinese steel prices. In case the Chinese economy recovers slowly, Chinese steel mills will still tend to push steel exports to neighboring markets, including Vietnam.

According to Hoa Phat Group, the average price of hot rolled coil (HRC) and rebar in China is about 6%-10% lower than the average price of Vietnam due to the ability to import coal from Russia. with better price.

However, Hoa Phat Group said that competition from China is not a major concern for this group because transportation costs and self-defense taxes on construction steel continue to offset Chinese steel prices. Lower country. In addition, HRC from Vietnam is also often preferred over steel from China to produce products for export to developed markets such as the US due to high tariffs on steel originating in China.

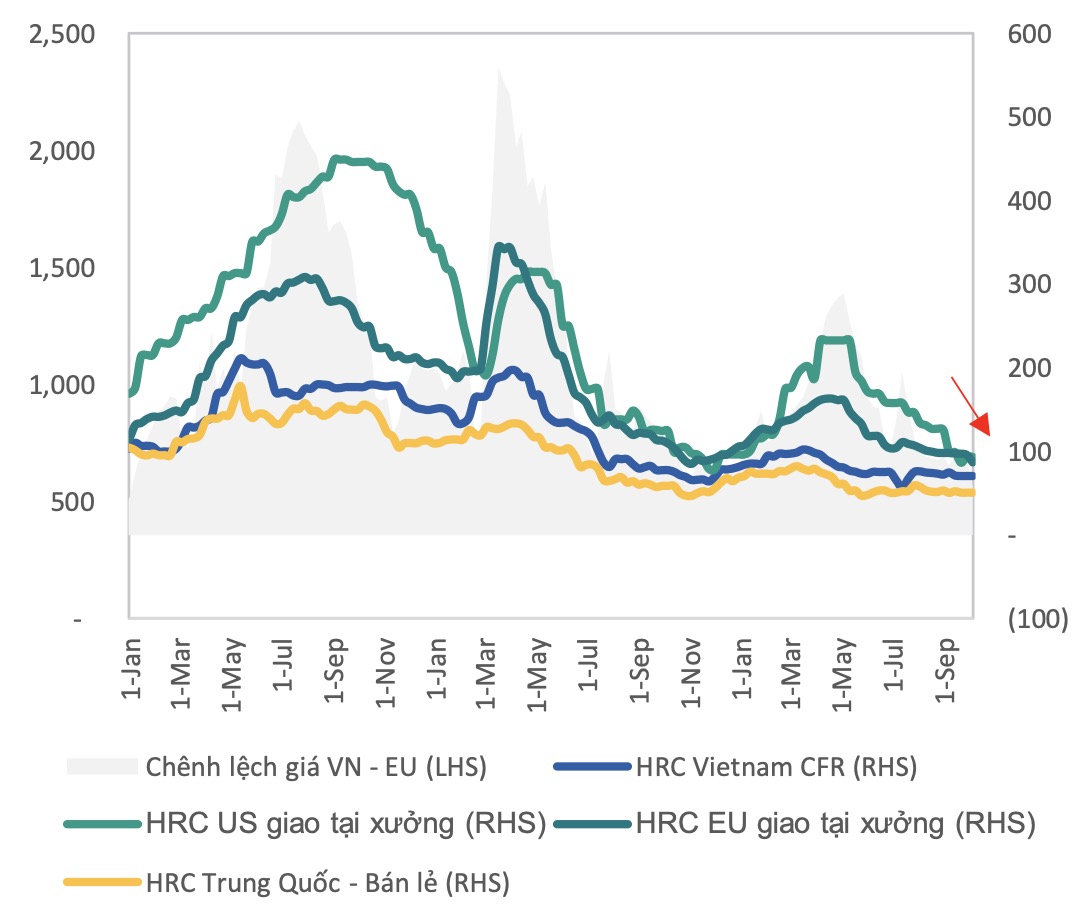

HRC price developments in the recent period. (Source: Compiled by BSC Equity Research)

In addition, BSC Equity Research noted that Vietnam's steel industry may face trade defense measures from some countries when export output has increased sharply in recent times while the steel industry in many importing countries are also having difficulty. Currently, some countries such as India, Malaysia... have introduced defensive measures to protect the domestic steel industry.

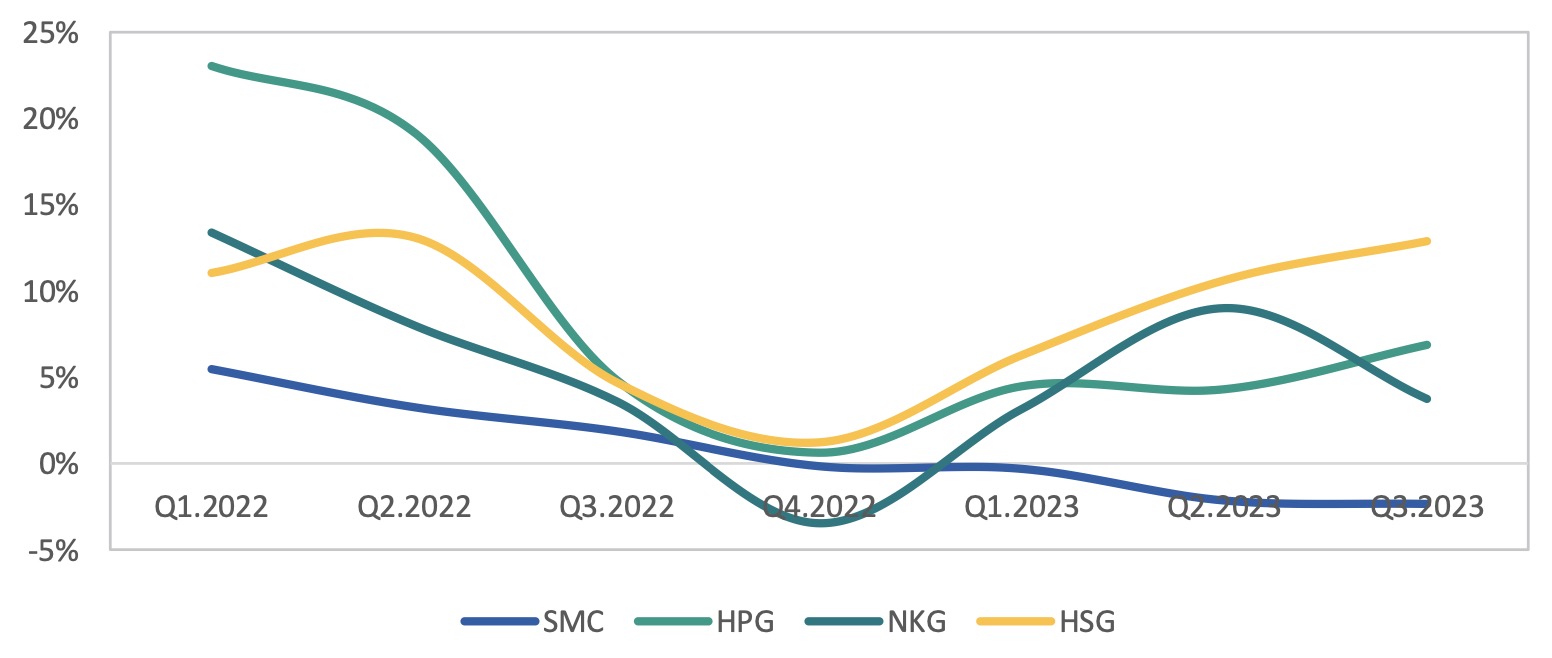

From the above factors, BSC Equity Research believes that the gross profit margin of steel enterprises listed on the Vietnamese stock market will be under downward pressure when input costs are high and domestic consumption has not improved. improvement, and export output declined.

Gross profit margin developments over the quarters of some steel enterprises listed on the stock market. (Source: Compiled by BSC Equity Research)

Looking back at the third quarter of 2023, the gross profit margins of steel enterprises have differentiated. The gross profit margin of Hoa Phat Group Joint Stock Company (stock code HPG) and Hoa Sen Group Joint Stock Company (stock code HSG) increased from 2.3-2.5 percentage points compared to the quarter. February 2023, thanks to the sharp decrease in input material prices at the end of the second quarter of 2023 - the basis for these two businesses to have better cost of goods, while export output is at a high level. In contrast, the gross profit margin of Nam Kim Steel Joint Stock Company (stock code NKG) has decreased by 5 percentage points compared to February 2023, mainly due to reduced export prices.

Industry and trade magazine

English

English  Vietnamese

Vietnamese

w300.jpg)