A steel smelting facility in China. (Photo: Reuters).

On December 27 - the last Monday trading session of 2021, the prices of steelmaking materials in China all turned down due to relatively weak demand. The price of coke (coke) at one point fell more than 4% and the iron ore price for futures also cooled down after bouncing up last week.

Specifically, as noted by Reuters, the price of coke futures on the Dalian Commodity Exchange fell 4.1% to 3,002 yuan/ton (equivalent to more than $471/ton), earlier in the beginning. the price session sometimes fell to 4.8%.

The price of metallurgical coal (coking coal) for May delivery lost 3.6% to 2,203 yuan/ton (equivalent to 345.8 USD/ton). At the beginning of the session, the price of metallurgical coal fell 2.8% to 2,222 yuan/ton.

Also according to Reuters, iron ore prices lost 1.9% to 693 yuan / tonne (about 108.75 USD / ton), reversing gains recorded in the futures and spot markets last week. Consulting firm SteelHome said that on December 24, the spot price of 62% Fe iron ore to China increased by 2.5 USD to 127.5 USD/ton.

In the last Monday session of the year, steel prices on the Shanghai Commodity Exchange recorded mixed fluctuations. Rebar used in construction fell 3.7% to 4,348 yuan/t (about 682 USD/mt), while hot rolled coil futures lost 4.1% to 4,432 yuan/mt (more than 695). USD/ton).

On the contrary, the price of stainless steel for December delivery increased by 1.2% to 16,895 yuan/ton (equivalent to more than 2,651 USD/ton).

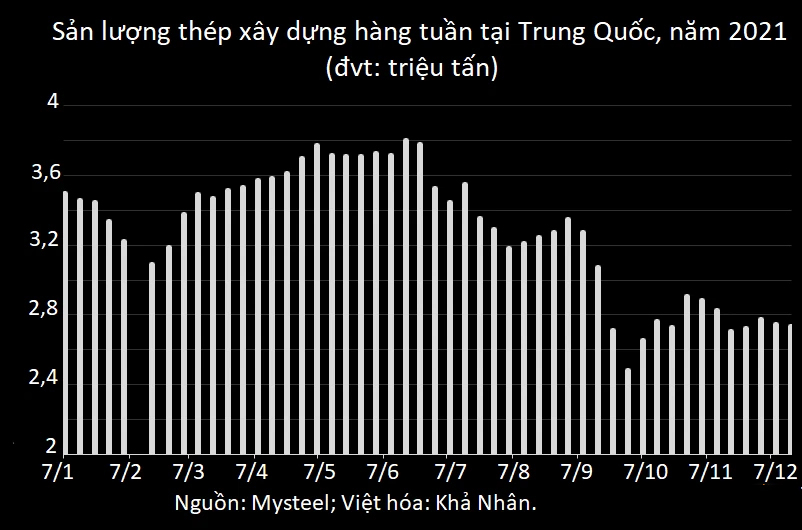

Data from consulting firm Mysteel showed that the weekly steel output of major steel firms in China reached about 8.9 million tons last week, down about 2.5% from the previous week.

Sharing with Reuters, analysts at consulting firm SinoSteel Futures said: "Average daily output of smelted iron ore remains at a record low... Elsewhere, coke inventories at mills are high. than in the same period in previous years".

In the context that Beijing is likely to continue its policy of controlling crude steel output in the medium and long term, coke prices may fall even further and demand is unlikely to recover to high levels.

Vietnambiz

English

English  Vietnamese

Vietnamese

w300.jpg)