In a report published on April 14 entitled "Short Range Outlook (SRO) for 2022 and 2023" (rough translation: Steel market outlook for 2022 and 2023), the World Steel Association (Worldsteel) identified demand Global steel in 2022 will increase only 0.4% to 1,840.2 million tons, after increasing 2.7% in 2021. In 2023, the organization has not yet given a forecast figure because of the war in Ukraine. making all forecasts highly biased.

According to Worldsteel, global inflation and uncertainty due to the conflict between Russia and Ukraine cloud the outlook for world steel demand.

Commenting on this market outlook, Máximo Vedoya, Chairman of the Economic Committee of the Association, said, "The forecast for the short-term market outlook comes amid the shadow of the economic tragedy and people after the serious crisis between Ukraine and Russia We all want this war to end as quickly as possible…

…In 2021, the steel industry's recovery from the pandemic shock has been stronger than expected in many regions, despite the continued supply chain problems and Covid-19 wave. However, a stronger-than-expected deceleration in China has resulted in a slowdown in global steel demand growth in 2021. For 2022 and 2023, the outlook is highly uncertain. Expectations for the economy to continue to stabilize after the pandemic have been shaken by the war in Ukraine and rising inflation.

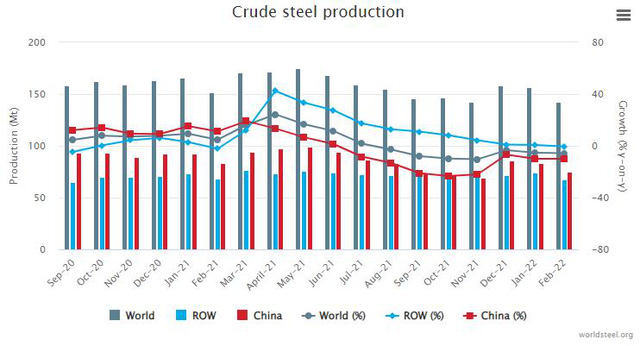

Those things have been evident in the output data from the beginning of 2022. Accordingly, global crude steel production in January 2022 decreased by 6.1% over the same period, continued to decrease by 5.7 more. % in February.

World crude steel production.

Global market

The extent to which each region is affected by the conflict in Eastern Europe will vary widely, depending on their direct commercial and financial exposure to Russia and Ukraine. At the present time, it can only be seen that everything in Ukraine has been devastated, the Russian economy has been severely damaged, and the impact is huge for the EU due to its dependence on Russian energy and its location. geographical proximity to the conflict zone.

The impact from this crisis will also be felt globally through soaring energy and commodity prices – particularly raw materials for steel production – and continued supply chain disruptions – which have already caused difficult for the global steel industry even before the war in Ukraine. Furthermore, financial market volatility and increasing uncertainty will weigh on investment activity.

Such spillovers from the war in Ukraine to the globe, coupled with low growth in China, suggest that growth expectations for world steel demand decline in 2022. There are additional risks from the continued increase in the number of Covid-19 virus infections in some parts of the world, especially China, and rising interest rates. The US tightening of monetary policies is expected to hurt financially vulnerable emerging economies.

The outlook for 2023 is even more uncertain. Worldsteel's forecast assumes that the conflict in Ukraine will end in 2022 but sanctions against Russia will largely remain after that.

In addition, the geopolitical situation surrounding Ukraine poses significant long-term implications for the global steel industry. Among them are likely to be a realignment of trade flows around the world, a change in energy trade and its impact on the energy transition and continued supply chain reconfiguration. global response.

Chinese market

China's steel demand plummets in 2021 due to tough government measures against real estate developers. Steel demand in this country in 2022 will not change due to the Government's efforts to boost infrastructure investment and stabilize the real estate market. Stimulus measures introduced in 2022 are likely to support steel demand growth slightly in 2023. It is likely that demand will be positively supported by further stronger stimulus measures. That could happen if the economy faces more challenges from the external environment - which is on a downward trend.

Developed economies

Despite the sporadic wave of Covid-19 infections and the supply chain constraints of the manufacturing sector, steel demand will recover strongly in 2021, especially in the EU and US. However, the outlook for 2022 has softened due to inflationary pressures, which is further reinforced by events surrounding Ukraine. The impact of the war will be especially pronounced in the EU, which is heavily dependent on Russian energy. Steel demand in the developed world is forecast to grow by 1.1% and 2.4% in 2022 and 2023, respectively, after recovering 16.5% in 2021.

Developing economies excluding China

In developing economies, the post-pandemic recovery faces more challenges as the impact of the pandemic continues, coupled with rising inflation, which has fueled the tightening cycle. currency in many emerging economies. After falling 7.7% in 2020, steel demand in developing countries (excluding China) has grown by 10.7% in 2021, slightly lower than Worldsteel's previous forecast. In 2022 and 2023, those emerging economies will continue to face worsening challenges from the external environment, the conflict between Russia and Ukraine, and monetary tightening in the US, leading to growth is low, only 0.5% in 2022 and 4.5% in 2023.

Worldsteel/cafef

English

English  Vietnamese

Vietnamese

w300.jpg)