If Russia rejects steel, Europe will have to look for substitutes in neighboring countries like Turkey.

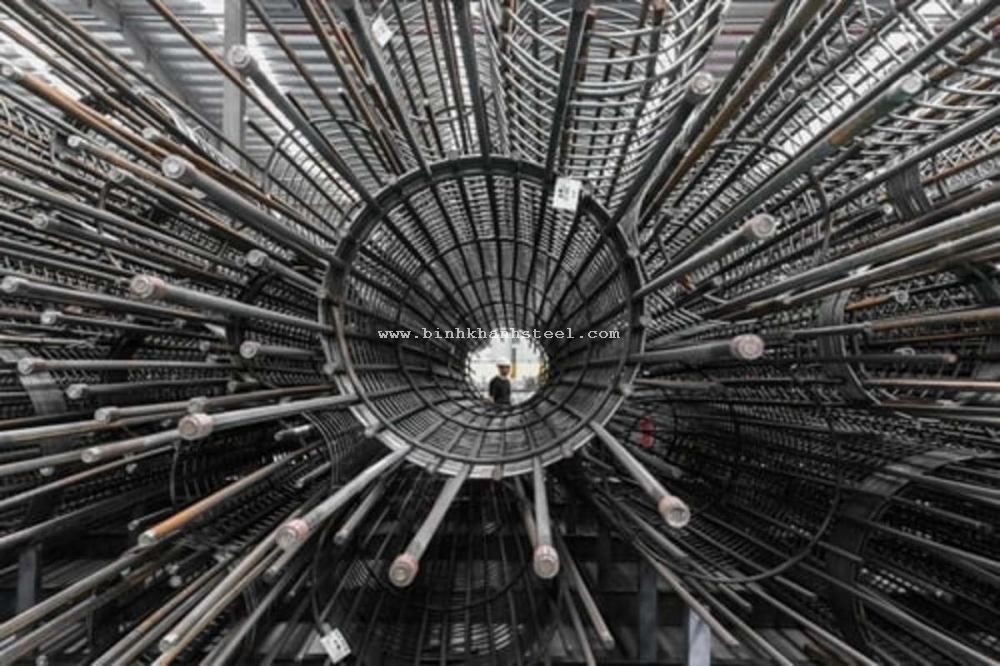

Overview of the world's steel production capacity

The growth of steel production capacity in Asia and the Middle East makes it difficult to reorient the exports of Russian steelmakers from Europe to the east amid the new EU sanctions banning them. Russia supplies semi-finished steel.

Global steel production capacity in 2021 has increased from 1.3% to 2.49 billion tons, of which most of the increase (80%) will come from Asia and the Middle East. The utilization rate of all factories in the world is about 81%. It is the excess of the world's steel production capacity that will be one of the factors hindering the development of the Russian metallurgy industry.

It should be recalled that on March 15, the European Union issued a ban on the import of a wide range of Russian steel products, including rolled steel products and steel pipes. The next package of sanctions, the eighth, which could be passed in early October, will most likely include a ban on the export of semi-finished products, including steel plates.

Status of metallurgical production of Russia

Last year, Russian metallurgists produced 65.9 million tons of steel products. Consumption reached 40.8 million tons, export - 28.3 million tons (the missing quantity must be imported). According to the authors of the strategy, 7 million tons of metallurgical goods will have to be diverted.

The Russian Ministry of Industry and Trade predicts that this year production will decrease by 6-7%, consumption by 5% and exports by 8%-13%. At the same time, to maintain market share, Russian companies have to reduce prices by 30-40% for new customers, not to mention the damage caused by longer transportation distances and complicated logistics.

When the new territories that became part of the Russian Federation are restored on October 3, significant construction work will be required to restore infrastructure. However, the reality is that the demand will not be high. For the foreign market, the problem of where to send goods will be extremely difficult.

Europe buys steel from Russia because Russian production is quite cheap, unlike the EU, especially now, when energy costs in the EU are high. If Europe rejects Russian products, they will have to look for substitutes elsewhere. Most likely, alternative sources of supply are located in neighboring countries such as Turkey, which is known for its scrap metal processing and primary production. This country has access to Russian coal and gas, so this helps to ensure the competitiveness of products.

It cannot be said that Russia will completely lose the European market, as some volume may reach Europe through Turkey, but if Turkey does not buy Russian steel to resell to Europe, Russia will be in vain. difficult to completely replace this market.

Where is the solution?

Iran's metallurgical capacity is less than Russia's, but it is enough for its own needs. In Central Asian countries, steel consumption is not so high. It can grow, but these markets have a lot to do with China's supply and China's steel is also quite cheap.

China is the largest steel producer in the world so it will be extremely difficult to penetrate the market with their products. Unless they might be interested in buying and selling finished products for steel production.

Japan is also a supplier of steel. They have a lot of companies like Nippon Steel Corporation, and are also having problems with sales due to falling demand. South Korea produces enough steel for the shipbuilding industry, and these markets are not easily accessible to Russia.

The only market left is India. But India is very interested in developing its own production, so most likely it will not let Russian steel in.

This means that Russia will have to rely solely on the domestic market and be able to deliver to Europe through other countries. Almost the same way Saudi Arabia is doing with Russian oil: Supplying its raw materials to Europe, then buying from Russia and reselling under its own brand to those who need it.

The biggest expectation is different projects from Africa, but Africa is a very volatile continent so it cannot be relied on alone.

One of the possible sources of demand is the restoration of new territories. Russia also has a global project connecting the eastern and western resource facilities for the Gazprom pipelines, as well as the Soyuz Vostok gas pipeline, which will become the sequel to the Power of Siberia pipeline- 2 passes through the territory of Mongolia. This project required a large number of thick pipes of large diameter.

In addition, if Russia continues to develop railway links with China, including highways, this will require a lot of raw materials from the metallurgy industry, including steel products.

Regarding the outlook, it can be assumed that metal consumption in the domestic market will increase due to the recovery of newly merged territories, transshipment projects or joint industrial projects with China. .

Labor

English

English  Vietnamese

Vietnamese

w300.jpg)