High growth on a low base

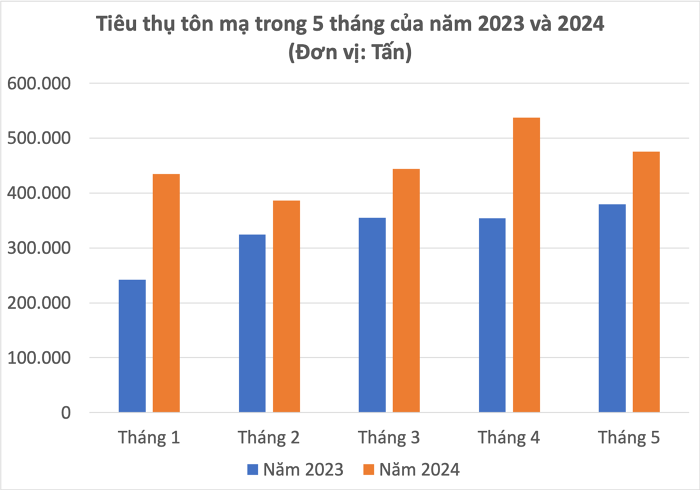

The galvanized steel market is showing signs of improvement compared to the same period last year in terms of both production and consumption. According to data from the Vietnam Steel Association (VSA), in May, galvanized steel output reached 509,309 tons, up 35% over the same period last year; sales volume reached 475,399 tons, up 25%.

In the past 5 months, the output reached more than 2.3 million tons and the consumption reached 2.27 million tons, up 32% and 38% respectively over the same period last year. In which, Hoa Sen Group continues to lead the market share with 29%, followed by Nam Kim (17.3%).

Data: VSA (compiled by H.Mì)

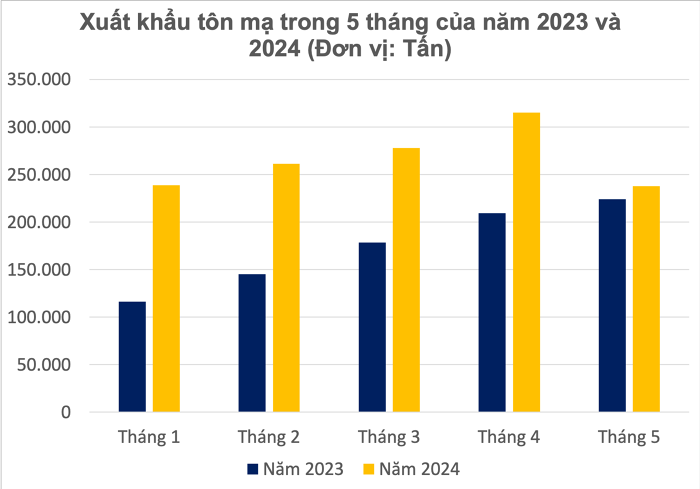

Hoa Phat, the fifth largest company in terms of market share, said that its galvanized steel export volume in the first 5 months nearly doubled compared to the same period last year. Galvanized, cold-galvanized and color-coated steel coil exports currently account for 60-70% of the total production output of Hoa Phat Color-coated Steel Factory.

The Vietnam Steel Corporation (VNSteel - Code: TVN) recently announced that total system-wide consumption in May reached 351,700 tons, up 1% compared to the previous month and up 59% compared to the same period last year. Of which, cold-rolled steel and galvanized steel consumption both doubled compared to the same period last year. In the first 5 months, cold-rolled steel consumption increased by 85% and galvanized steel increased by 105% compared to the same period last year.

Although the growth was high compared to the same period last year, the recovery is still considered weak due to the low base level of the previous year. In fact, galvanized steel consumption in May decreased by 11.5% compared to April, of which exports decreased by more than 24%.

Data: VSA (compiled by H.Mì)

In a recent report, BIDV Securities (BSC) expects that in the second half of this year to 2025, galvanized steel prices will be on an upward trend. In June, BSC said that domestic galvanized steel prices will fluctuate near the supply-demand balance, equivalent to the price range of October 2023.

In addition, domestic steel output will recover due to the return of the real estate market. Dealers tend to stockpile more inventory than during the anti-dumping tax period.

"We believe that galvanized steel prices in 2024 will increase by 5% compared to last year," BSC said.

How will the anti-dumping investigation of galvanized steel affect?

Recently, on June 14, the Ministry of Industry and Trade initiated an investigation to apply anti-dumping tax on galvanized steel products from China and South Korea. This is expected to be a positive factor supporting the domestic galvanized steel industry.

In order, the Ministry of Industry and Trade will send the Review Questionnaire to relevant units after 15 days from the date of initiation. This will be the basis for drawing a preliminary conclusion of the investigation. Investigation period to determine dumping behavior (POI) April 1, 2023 - March 31, 2024.

The Ministry of Industry and Trade will make a decision to impose anti-dumping tax based on the following three factors. First, determine the dumping margin > 2%, whether there is price pressure or price suppression. Second, the level of damage to the domestic manufacturing industry. Finally, the causal relationship between the dumping phenomenon and the damage to the domestic manufacturing industry.

If the final conclusion is to re-impose taxes, the galvanized steel industry is expected to grow strongly again.

Previously in 2016, the Ministry of Industry and Trade also initiated an investigation into anti-dumping tax on galvanized steel imported from China, and decided to apply temporary anti-dumping tax after 6 months, and officially apply anti-dumping tax after 12 months (case code: AD02).

Since the application of temporary anti-dumping tax in September 2016, the average domestic galvanized steel output of the whole industry reached 450,000 tons/quarter (an increase of 18% compared to the period before the tax was applied). In particular, Hoa Sen, the enterprise with the largest market share in the galvanized steel industry (estimated at 30% market share), has increased its output by 30% compared to the period before the tax was applied.

Other galvanized steel enterprises also recorded strong growth in domestic output (from 18% - 30%) after the anti-dumping tax was applied. A typical example is Nam Kim, where the average domestic output reached 50,000 tons/quarter, an increase of 29% compared to the period before the tax was imposed.

By May 2022, Vietnam will end the tax imposition of the AD02 case.

Sharing at the conference summarizing the steel industry in 2023 and the 2024 plan of the Vietnam Steel Association earlier this year, Mr. Vu Van Thanh, General Director of Hoa Sen Group, said that since Vietnam stopped the AD02 case, the amount of galvanized steel imported from China to Vietnam has increased significantly.

"Businesses are having an extremely difficult time competing. From the perspective of the galvanized steel industry, we hope that the Trade Remedies Authority will speed up the progress of the AD02 case," Mr. Thanh said.

Talking to us, Mr. Nghiem Xuan Da, Chairman of VSA and General Director of VNSteel, said that in the first months of the year, the amount of steel imported from China to Vietnam increased dramatically. This puts pressure on domestic steel enterprises. Therefore, the Association has recommended that the Government and state management agencies take necessary measures such as trade defense to protect the domestic steel industry.

Vietnambiz

English

English  Vietnamese

Vietnamese

w300.jpg)